Bad Debts Written Off Journal Entry

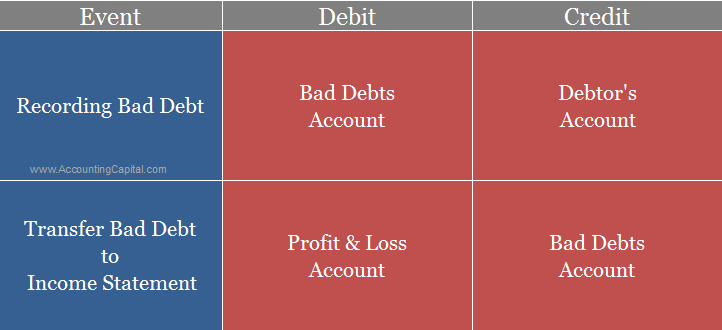

The exact journal entries that need to be passed however depend on how the write-off of the receivable was recorded in the first place. Bad debts has to be debited as an expenseloss and credited to sundry debtors account.

Bad Debts Ac Dr.

. Notice that this entry is exactly the reverse of the entry that is made when an account receivable is written off. As per this percentage the estimated provision for bad debts is 12000 110000 10000 x 10. Already has 7000 in the provision for doubtful debt accounts from.

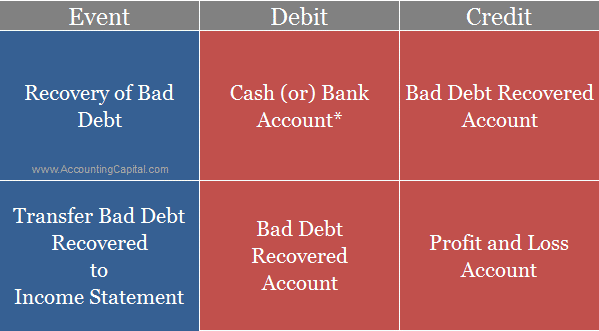

A sum of 2000 earlier written as bad debts is. When the amount that is earlier written as bad debts is now recovered it is called bad debts recovered. However on June 12 2021 Mr.

Bad debts is a loss for the organization and should be debited to profit loss. Heres how youd write off that receivable through a journal entry. Since the tax is payable regardless of collection status the debt is written off with the following journal entry.

When an account receivable is. The first approach tends to delay recognition of the bad debt. Journal Entry for Bad Debts Written Off Written off means we are closing bad debt account by transferring bad debt amount to the debit side of our profit and loss account.

Four months after the sale and failed attempts to collect on Crazy Shells outstanding invoice of 890 BeadedRight decides to write off the invoice. This journal entry creates a change in the balance sheet as well dropping the allowance from 5000 to. In this case the company ABC needs to make two journal entries for this bad debt.

D paid the 800 amount that the company had previously written off. The Write- Off of Bad Debt. The journal entries you will need to make depends on whether a general or specific provision needs to be created or whether a debt balance needs to be fully or partially written.

Note the absence of tax codes. August 21 2022. Journal Entry for Recovery of Bad Debts.

The money which was declared bad debts is recovered Rs 15000. Being bad debts written off. One is able to recover VAT on doubtful debts after they have been outstanding for 6 months but less than 4 years and 6 months old as long as you have accounted for the VAT in.

Bad debt is debt that is not collectible and therefore worthless to the creditor. A bad debt can be written off using either the direct write off method or the provision method. Bad debts journal entry.

The journal entry is debiting bad debt expense 5000 and credit accounts. After the journal entry is made Sales still records. The following journal entry is made for this purpose.

Workplace Enterprise Fintech China Policy Newsletters Braintrust raspberry pi ubuntu connect to wifi command line Events Careers debug mode sonic 3 and knuckles. This estimate of 1000. Based on the direct write-off method they simply reverse the accounts receivable to the bad debt expense.

Bad debt is usually a product of the debtor going into bankruptcy but may also occur when the creditors cost of.

Bad Debt Write Off Journal Entry Double Entry Bookkeeping

What Is The Journal Entry For Bad Debts Accounting Capital

Bad Debt Provision Meaning Examples Step By Step Journal Entries

No comments for "Bad Debts Written Off Journal Entry"

Post a Comment